In a move that is set to stir up fresh controversy, American asset management giant BlackRock has agreed to acquire two ports at either end of the Panama Canal from a Hong Kong-based firm. The deal, which is reportedly worth billions of dollars, is likely to reignite tensions between the US and China, as well as raise concerns about the control of critical global infrastructure.

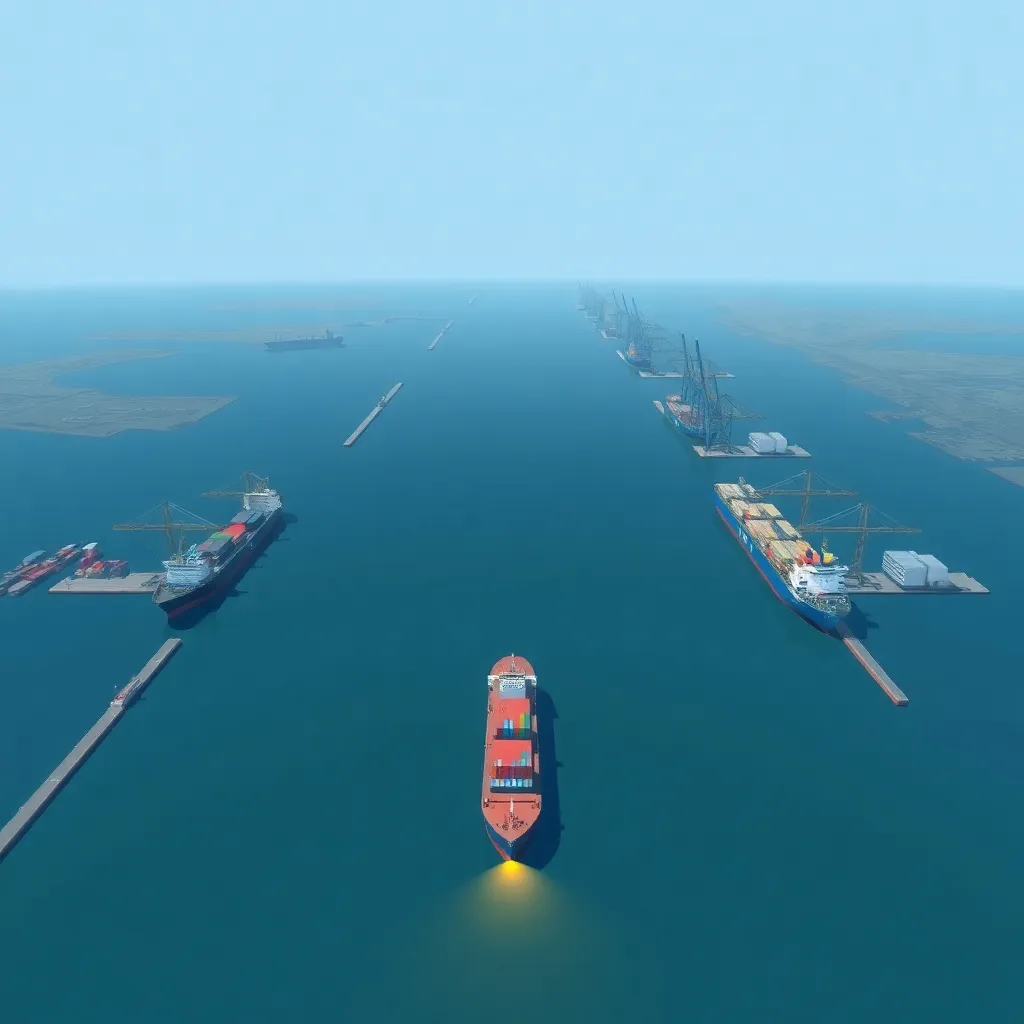

The Panama Canal, one of the world’s most important shipping lanes, connects the Atlantic and Pacific Oceans and is a vital artery of international trade. The two ports in question, located at either end of the canal, are currently owned by a Hong Kong-based company that has been at the center of a firestorm of criticism from former US President Donald Trump.

During his presidency, Trump repeatedly expressed concerns about the security implications of Chinese control of the Panama Canal, which is used by thousands of ships every year to transport goods between Europe and Asia. The former president argued that Chinese ownership of the canal posed a threat to US national security and economic interests.

While the acquisition of the ports by BlackRock is likely to alleviate some of these concerns, it also raises new questions about the control of critical infrastructure by private companies. BlackRock, which is one of the world’s largest asset managers, has significant investments in a range of industries, including energy, finance, and technology.

Critics of the deal are likely to argue that the acquisition of the ports by BlackRock will concentrate too much power in the hands of a single company, potentially threatening the interests of other stakeholders, including the Panamanian government and local communities.

The deal is also likely to be scrutinized by regulators in the US and Panama, who will need to assess whether it complies with relevant laws and regulations. In the US, the Committee on Foreign Investment in the United States (CFIUS) is likely to review the deal to determine whether it poses any national security risks.

Overall, the acquisition of the Panama Canal ports by BlackRock is a significant development that is likely to have far-reaching implications for global trade, security, and the control of critical infrastructure. While it may alleviate some concerns about Chinese control of the canal, it also raises new questions about the role of private companies in the management of critical global assets.